Effective Ways to Create Bank Loyalty Programs in 2024

Author

admin

Published on:

Mar 15, 2024

Table of Content

See How Our Loyalty Program Can Help You.

Let us guide you through our product features with Loyalty Experts

To understand what is a brand loyalty program, we need to first understand the importance of customer loyalty in the banking industry. A cornerstone of every banking strategy is cultivating a customer loyalty program for banks. This is essential to retain clients, provide them with superior services, and encourage repeat business. Enhancing client experience remains a top priority for banks today, but numerous technological and cultural obstacles are impeding their progress.

Consumers today both corporates and individuals need easy access to services across several channels, and banks must develop relevant, customized banking experiences to attract, grow, and retain their clientele. Additionally, banks must now adopt an omnichannel bank loyalty program that is secure, clean, and green to have a single perspective of the consumer.

Think of it this way: These best bank loyalty programs are like the glue that holds businesses together. They aim to ensure that businesses trust each other and desire to continue working together.

2024 is regarded as a major turning point for loyalty programs more so with regards to corporate banking. In this blog, we delve into bank loyalty program trends 2024. Let’s explore how loyalty programs are evolving and how they may be the secret to mutually beneficial commercial partnerships.

What are the challenges faced by clients in financial services?

High level of competition

There is a lot of competition in the B2B banking market. It might be difficult to draw in and retain business clients in the face of competition from multiple financial institutions. In an extremely competitive market, banks must differentiate themselves and become the go-to option.

Increased client expectations

The customer loyalty programs for banks are always changing due to changes in client behavior and technological improvements. To provide seamless digital experiences, individualized services, and practical financial solutions, banks must stay up to date with these changing demands.

Enhanced churn rate

Due to the convenience of switching, consumers are more inclined to move to a different banking provider if they are unhappy with their current one or discover a better deal elsewhere. To lower churn rate and increase client satisfaction, banks should concentrate on developing trusting relationships and offering value-added services.

Regulatory compliance

To safeguard consumers, the banking sector is bound by stringent laws governing marketing techniques. The marketing and legal departments must work closely together to ensure that financial institutions are able to promote their services while adhering to these restrictions effectively.

Loyalty Programs for Banking and Fintech

1. Point-based loyalty programs

Point-based loyalty programs are a great way to build long-lasting relationships in the B2B banking industry. Through the structured incentive system these programs offer, businesses can earn points through the bank reward programs, depending on their financial transactions and activities. First of all, companies value the material benefits that come with accumulating points, such as exclusive financial insights, priority customer assistance, or discounts on banking services. Secondly, loyalty programs that are based on points help the bank retain customers. We need to know what are the biggest challenges to customer retention in financial services. Banks can improve their relationship with companies and discourage them from looking for other options in the competitive market by offering bank loyalty program rewards for continuous B2B engagement. Let us look at the successful bank loyalty program examples.

Customers can receive points for qualifying purchases made with a Chase credit card through Chase Bank’s point-based rewards program, Chase Ultimate Rewards. For every transaction, the customer earns points and with these points, they can redeem it with rewards like travel perks, merchandise, gift cards, and so on.

2. Tiered loyalty program

Different levels or tiers of advantages are offered by tiered loyalty programs according to the expenditure levels or client loyalty. Clients, in the B2B sector, get access to more benefits and privileges as they advance through the tiers. Exclusive loyalty program benefits for banks like priority customer service, favorable interest rates, or access to private events are sometimes offered to higher levels. Tiered loyalty programs provide clients with increasing rewards as they advance through various tiers according to their level of bank customer engagement strategies. In addition to encouraging greater participation and stronger client loyalty, this technique gives banks insightful data-driven bank loyalty program for tailored services and product recommendations.

For instance, Capital One’s SavorOne is a tiered-category card. It provides 3% cash back indefinitely on restaurants, entertainment, popular streaming services, and groceries. The Savor Rewards card offers comparable benefits.

3. Cashback loyalty program

Clients that participate in cashback loyalty programs receive cash credit benefits in proportion to their purchases. This gives clients a concrete benefit and stimulates spending. Customers receive cashback for using credit cards or banking services, which serves as a concrete and immediate reward for their financial activity. Providing a clear and worthwhile reward linked to their banking transactions, not only raises the client’s pleasure but also promotes ongoing engagement and loyalty. Banks can further increase client loyalty by integrating cashback programs into these payment methods, which has become increasingly common with the advent of Buy Now Pay Later services in B2B.

An intriguing promotion from Citibank allows qualified credit cardholders to accrue bonus Cashback, Reward Points, or Turbo Points on their eligible online purchases made with the credit card. Cardholders who take advantage of this promotion will receive 10% more in reward points, cashback, miles, or turbo points on all qualifying online purchases.

4. Exclusive privileges and advantages

In banking, loyalty programs can grant members access to exclusive benefits and privileges. These could be special loan rates, concierge services, discounted or waived fees, access to airport lounges, or one-on-one financial counseling. Banks can create a sense of exclusivity and meet the specific demands of their customers by offering these exclusive privileges. Exclusive benefits like customized financial plans, committed relationship managers, and fee waivers are essential in the world of B2B banking. By giving companies specialized assistance, financial savings, and strategic insights, these products and services build long-lasting relationships and help banks stand out in the market.

The HDFC Diners Club Privilege Credit Card provides benefits related to daily living, including discounts on dining, shopping, and entertainment. Users may take advantage of Buy One Get One deals on BookMyShow, quarterly milestone incentives from Decathlon and Marriott, and expedited rewards on well-known brands like Zomato and Swiggy. The card also touches on the premium market significantly thanks to features like 10X rewards on SmartBuy and a low 2% FX markup, making it a good option for those seeking “premium” perks at a reasonable cost.

5. Coalition loyalty programs

Coalition loyalty programs involve partnerships with other businesses to offer a wider range of benefits and rewards. Numerous cooperating partners offer rewards and points that consumers can redeem. This type of program increases the opportunities for customers to earn and redeem incentives, increasing the attraction of the loyalty program.

For instance, an alliance of businesses and a bank could work together to provide exclusive programs, group savings, or bundled incentives to their mutual clientele. Through the promotion of interactions between B2B clients and other enterprises within the coalition, this innovative approach builds a community-driven loyalty ecosystem that ultimately enhances customer satisfaction and retention in a range of industries.

First U.S.-based loyalty alliance program, Plenti, was introduced by American Express. Enrolling in the Plenti program is free of cost, and American customers can accrue points and savings by making purchases with any payment method that the participating brands accept, including as cash, prepaid cards, debit, charge, or credit cards.

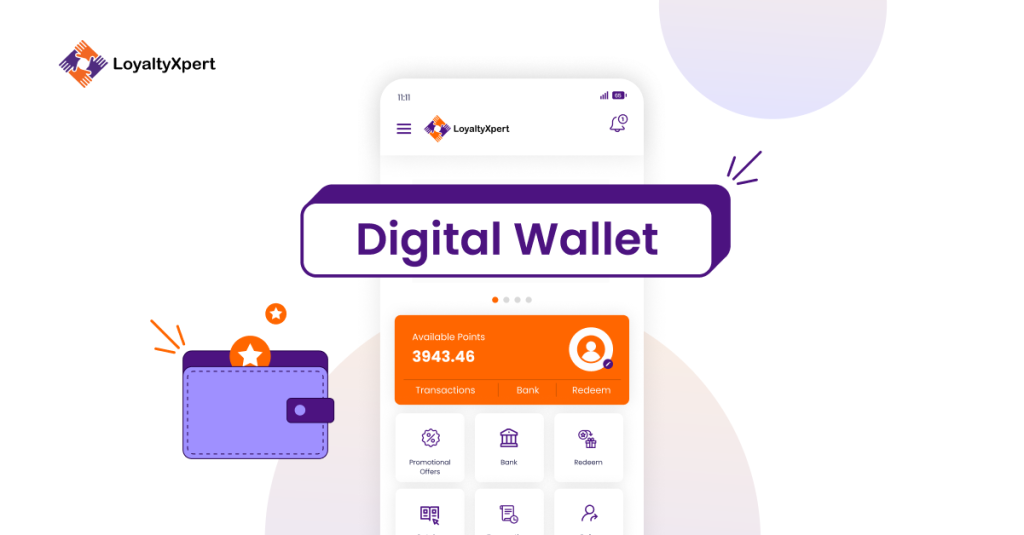

6. Digital wallets

The trend of incorporating loyalty programs into digital wallets has grown in popularity as digitalization has increased. Through their digital wallets or mobile banking apps, customers may easily earn and redeem points, improving the convenience and accessibility of the loyalty program. This connection promotes participation in the loyalty program and improves the overall client experience, in the B2B setting. With digital wallets, you may use your device to make payments while shopping, eliminating the need to bring your cards with you. After entering and storing your bank account, credit card, or debit card details, you can use your device to make payments.

For example, Retailers and entrepreneurs can begin collecting digital payments right now by using the Google Pay app and their current account. Your bank account receives the payment straight; there are no fees.

Case Study on Wells Fargo

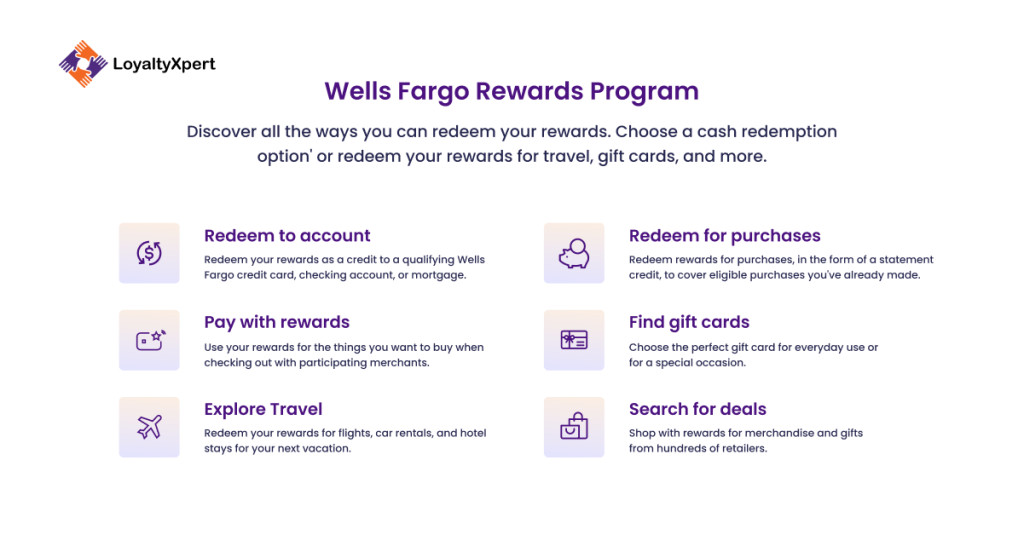

Let us understand the Best Practices and Case Studies of Wells Fargo. While credit and debit cards are a major component of many bank loyalty programs, many are not. In addition to additional benefits like no ATM fees and safety deposit box reductions through their Relationship Discount program, Wells Fargo offers lower rates on auto and student loans.

Relationship discounts are given to active customers who use services like auto-payment and apply to consumer checking accounts with automatic payment activated. In addition to discounts on a number of Wells Fargo services, the same program also provides cash-back reimbursements on items like charges made at other ATMs. Wells Fargo pays a heavy price for this scheme, but consumers are also highly motivated to use the bank more because doing so saves them a ton of money on fees and other charges. Customers who use Wells Fargo’s services are actively rewarded with higher interest rates on accounts and bonuses for possessing more than $25,000 or more than $250,000.

What insights does it offer you? Bank loyalty reward programs don’t have to be restricted to financial transactions; you can just as easily reward service usage, particularly when the services result in revenue generation or cost savings.

Wrapping Up

In 2024, developing successful bank loyalty programs will be essential for banks and companies alike. A variety of advantages are provided by loyalty programs, such as improved customer happiness, higher consumer involvement, an industry competitive advantage, and customized offers. They enable banks to create enduring bonds, obtain insightful data about their clients, and customize their services to suit specific requirements.

The loyalty equation turns into a potent instrument for banks and consumers alike in this rapidly changing digital age, producing a win-win situation that fortifies bonds, promotes growth, and cultivates a satisfying banking experience.

At LoyaltyXpert, we’ve developed numerous successful loyalty programs throughout the course of our many years in business. Look no further if you’re seeking for a loyalty solution partner who will support you at every turn and not only assist you in creating and managing successful bank loyalty programs but also stick by your side at every turn. Get a free trial or schedule a demo with LoyaltyXpert right now to learn about cutting-edge tactics for converting clients into ardent supporters.